- cross-posted to:

- nyt_gift_articles@sopuli.xyz

- cross-posted to:

- nyt_gift_articles@sopuli.xyz

Tax credits? Soy, lame.

Expropiate homes from those who have more than two.

Its funny how capitalists are behaving like low interest rates are a bad thing because people may own homes instead of giving half their income to a parasite.

Parasites don’t care what the interest rates are, they just pass on any excess costs to tenants.

The fed ruined the housing market with their Covid response. They dropped rates to near zero with absolutely no strings attached which let everyone with money maximize their leverage and buy all the housing as investments and drive up prices. The low rates should have been reserved for first time home buyers. Instead, investors went crazy and regular families got screwed with higher prices, and then later, higher rates and higher prices. Unless you bought during the 3 months during 2020 before everything exploded, or owned already and got to refi during Covid, everyone else got screwed.

This is the best summary I could come up with:

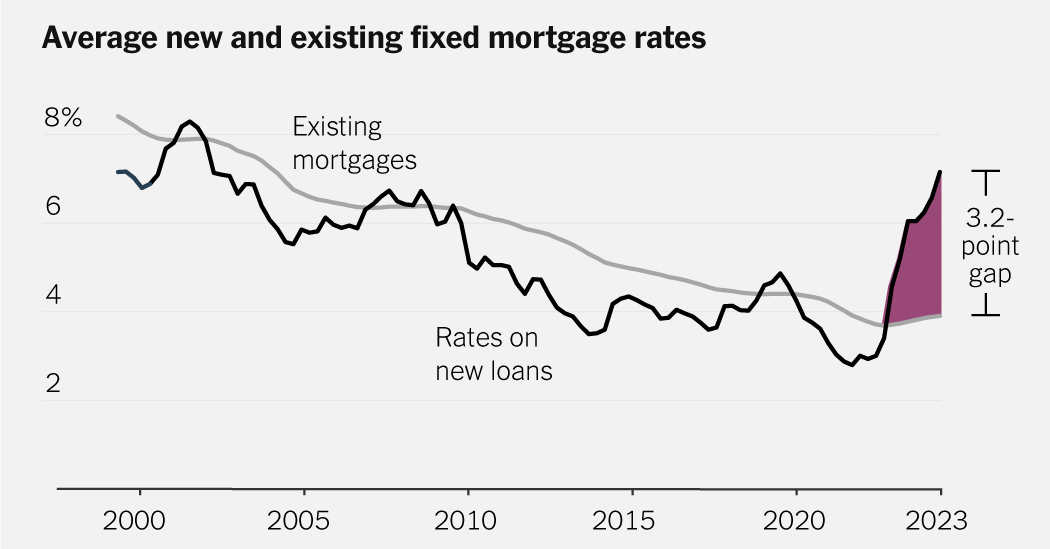

The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades.

Indeed, according to new research from economists at the Federal Housing Finance Agency, this lock-in effect is responsible for about 1.3 million fewer home sales in America during the run-up in rates from the spring of 2022 through the end of 2023.

Another way to state how unusual this dynamic is: Between 1998 and 2020, there was never a time when more than 40 percent of American mortgage holders had locked-in rates more than one percentage point below market conditions.

Professor Fonseca and Lu Liu at the University of Pennsylvania also find that homeowners who are more locked in are less likely to move to nearby areas with high wage growth.

Some of these effects may sound similar to the years after the 2008 housing crash, when a different problem — underwater mortgages — trapped many people in homes they wanted to leave.

For the homeowners who’ve so far been unwilling to sell, however, that sum is a good deal less than the $50,000 that locked-in rates are effectively worth to the typical mortgage holder.

The original article contains 1,230 words, the summary contains 209 words. Saved 83%. I’m a bot and I’m open source!

This article reframes people being able to afford to stay in their homes as some kind of crisis.

Not present at any point in this article; any evidence that any American is stuck in a home they would rather leave. They couldn’t even be bothered to quote a single homeowner who wanted to move let alone anything indicating that this is a common sentiment.

The only evidence cited are previous rates of housing mobility which are then taken simply as a natural norm with any deviation an unwanted aberration.

The idea that people might generally want to live in the homes they bought long term is not considered. The idea that those who move or downsize are often doing so reluctantly under pressure from their mortgage is not considered.

“Stuck” … yeah I’m stuck, with a bunch of calls, texts and e-mails basically begging me to cash in my equity. I LIKE my house and I make my payments on-time - leave me the hell alone!!

Well yeah. I wish I bought 2. I can get a house half the price of my current one and the mortgage will be like $200 more per month.